The bookkeeping profession has spent years debating the impact of artificial intelligence and automation. Will software replace compliance work? Will pricing models change? Will advisory become mandatory for survival?

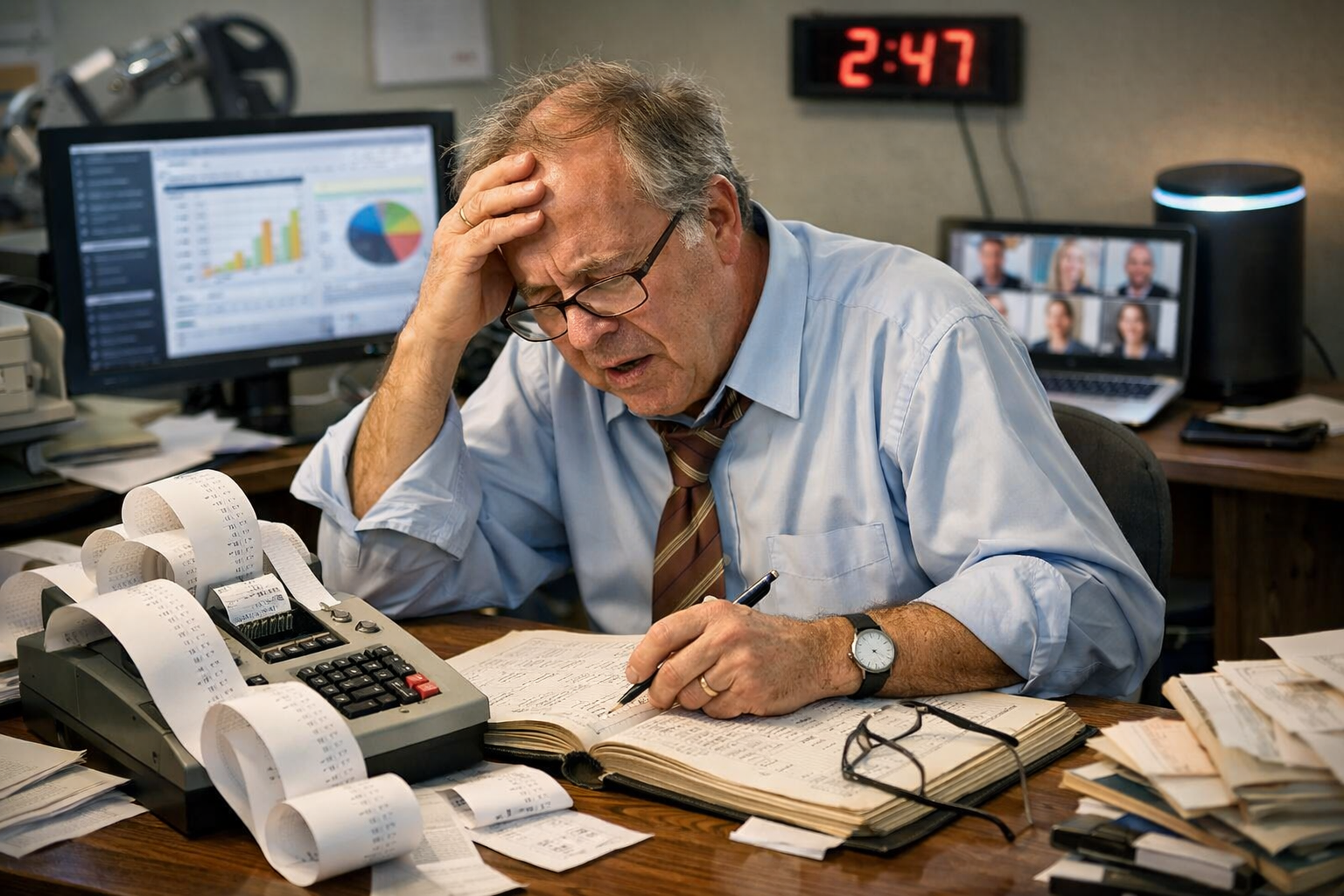

While these questions remain relevant, they miss a more immediate and practical risk facing bookkeeping businesses in 2026: falling behind the technology standards that clients now consider normal.

The issue is not AI replacing bookkeepers. It is outdated systems quietly eroding efficiency, credibility, and client experience.

Technology Is Now the Baseline

Cloud accounting is no longer progressive. Automated bank feeds, digital document capture, and integrated apps are no longer optional add-ons. They are expected.

Business owners operate in increasingly connected environments. Their banking, payroll, CRM, inventory, and payment systems are streamlined and automated. When they engage a bookkeeper, they assume the same level of digital competence.

Clients expect timely data, seamless integrations, structured workflows, and reporting that provides clarity rather than confusion. If their bookkeeping feels manual, reactive, or fragmented, it raises concerns — even if the work is technically accurate.

Technology has become part of perceived professionalism.

The Internal Cost of Falling Behind

The impact of outdated systems is not only external. It directly affects operational performance inside a bookkeeping firm.

Manual processes increase labour hours per client. Disconnected apps create duplication. Poor workflow management leads to bottlenecks, particularly around BAS and month-end deadlines. Quality control becomes heavily reliant on the business owner.

Over time, these inefficiencies compress margins and limit capacity for growth. The firm may remain busy, but not necessarily profitable or scalable.

By contrast, firms that deliberately align their tech stack with documented workflows create consistency. Automation supports accuracy. Team members follow standardised processes. Owners move from rescuing work to reviewing it.

The difference is rarely dramatic. It is structural.

AI Is a Tool — Not the Threat

AI-driven features are now embedded in many accounting platforms: transaction suggestions, anomaly detection, predictive insights, and automated data extraction.

These tools do not eliminate professional judgment. They require oversight, configuration, and critical thinking. Firms that benefit most from AI are those that integrate it into structured systems rather than resist it entirely.

Ignoring new tools does not protect a bookkeeping business. It increases the gap between service levels in the market.

Future-Focused, Not Trend-Chasing

Remaining competitive does not require adopting every new app. In fact, excessive tools can create complexity.

Instead, bookkeeping businesses in 2026 need deliberate system design. This includes reviewing current software regularly, ensuring integrations are functional, training team members properly, and documenting workflows that align with technology capabilities.

Accuracy and compliance remain foundational. However, in today’s environment, efficiency, visibility, and system maturity increasingly shape how clients assess value.

The greatest risk is not automation.

It is assuming that yesterday’s systems will meet tomorrow’s expectations.

In 2026, your technology is no longer operating quietly in the background. It forms part of the service itself — and the standard continues to rise.

Article by Katrina Aarsman

Author of Grow, Profit, Exit, mother of two and mentor Katrina Aarsman has been with Pure Bookkeeping since 2018. As spokesperson for Pure Bookkeeping Australia, Katrina uses her role to help bookkeeping businesses in a meaningful way. Along with leading development, implementing goals and upholding values, Katrina is dedicated to staying in touch, on top of trends and issues with the bookkeeping industry. Before Pure Bookkeeping, Katrina built a multi-staffed bookkeeping business that she sold in 2015. Since then she has guided, supported and helped bookkeepers build and grow their businesses. She continues to find new things that inspire her and the people around her. Currently, she is exploring meditation and dreaming of one day living by the water.

Subscribe Now

Recent Posts

- The Biggest Risk for Bookkeepers in 2026? Falling Behind Technology

- Why Bookkeeping Growth Feels Hard (And What Actually Fixes It)

- From Best Practice to Real Practice: Building a Better Bookkeeping Business

- Jumping Off the Cliff — and Why Entrepreneurs Need Systems to Fly

- Overcoming Overwork and Juggling Client Work with Business Admin